How did the Old-Timers Pay Their Bills?

The credit card was non-existent.

My friend, Tom DeNucci suggested this interesting topic. He and I chat often and live in a world of nostalgia.

We appreciate the past while embracing the present. And in our reminiscences, we laugh. We bark, “Oh yeah!” We dwell positively, ever weaving the stories of parents, relatives, and friends to those days of making us feel good. And it works. We feel good, connected, and comforted. We’ve adapted to the transformations.

Our stories become universal, realistic, and humorous; mostly because Tom has that unique ability to recognize humor in everyday situations, digest it, and then make it a story. Nostalgia inspires and connects us, and that’s a good thing. His recent query was, “How did your parents pay their bills in the old days?”

“Tom, how did yours? It’s a good idea for a story, so send something along.”

And so he writes . . .

Two things come to my mind.

First, the major bills were for utilities and insurance.

Secondly, my parents had a checkbook. Few did.

The utility bills . . . telephone, gas, and electric . . . were paid in person at Cardi’s Furniture Store in our neighborhood. Bill paying was a social event. Everybody knew each other in line, the woman at the counter was pleasant. People paid, chit-chatted for a moment, and left.

Imagine. People paid their bills at stores that had little or nothing to do with services rendered like utilities. The pay counter was tucked in the rear of the store. It resembled a miniature bank or post office.

My father always paid in cash. Who today walks to pay a bill in cash?

Home heating oil was also paid at the business, another counter chit-chat emporium. My father hitched a ride because it was too far to walk.

My wife Marie’s mother paid the oil man at the door. He rang the bell, “All set Mrs. M.”

“Ray-the-insurance-man“ visited many families in the same neighborhood.

He tapped on the door, entered, was welcomed ( imagine) chatted a bit, and then, like a Red Sox left fielder, jaunted across the kitchen and snatched a blue John Hancock envelope taped to the wall. Inside was the prize, the weekly payment of a few dollars. He nuzzled the cash into his manila envelope and stuffed the envelope into his briefcase. While continuing his chatter, he opened the door, smiled, and hummed, “See you next week.” They never missed a payment; he never missed a visit.

I didn’t know anyone who had a MasterCard or Bank of America card, but my mother had department store credit cards. Marie remembers her mother getting the Bank of America checking account which thrilled her because she could just put a check in the mail. “Can you believe it?” she would say. I don’t have to walk, and I don’t need a ride.”

As my mother got older, she had a debit card. Things changed for my father. Where he once walked to the bank to cash a check, they now had something innovative, high-tech, almost magic. It was the direct deposit. “I can’t believe it, Ida,” he was oft heard to say.

I also remember the breadman and milkman being paid in cash weekly. Their payments were confidently placed in their respective boxes near the door.

When Marie started to drive, her mother asked her to make a stop at the mall where she made a direct payment. “I can save on a stamp that way, Marie.”

How interesting, Ed. For years, people paid almost immediately in cash and never carried a credit card or a checkbook.

Thanks for this note, Tom. I continue . . .

The old-timers used a variety of methods to pay their bills: cash was the most common for smaller purchases and day-to-day expenses, then checks became popular in the mid-20th century. People also bartered. I remember doctors being paid with produce, a meal, or a service.

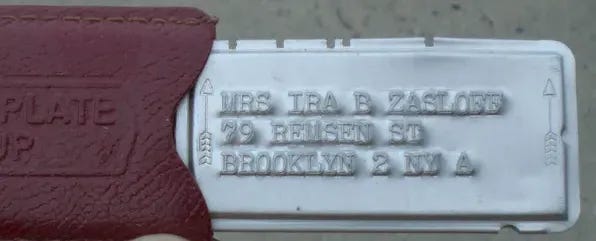

And then there were Charge-a-Plates, a precursor to credit cards issued by department stores, used to buy goods between the 1930s and 1950s. Metal and resembling dog tags, they were imprinted with the customer's name, city, and state. When a customer made a purchase, the clerk retrieved the plate and processed the purchase

.Then came the credit purchase. I worked in a department store during my Christmas breaks from college. That’s where I learned about the layaway plan for large purchases. “I’ve been paying for this for months. This is my last payment. I’m here to pick it up.” And off I went to someplace in the rear of the store to identify the tagged purchase and bring it out with a huge smile.

Local businesses offered credit to regular customers. Children were known to the storekeepers. They could be sent for items without carrying money. Merchants knew when payday was and when to expect payment. For the more expensive items bought on credit, householders made monthly payments.

After WW II, paying by checks became popular. Households without checking accounts could purchase money orders at supermarkets, chain drugstores, or post offices.

I learned about extending payments when I was a paperboy. I collected weekly, but it was common for my customers to miss a payment of fifty cents a week, or two, or three. I pursued them, even knocking on their doors on a Sunday. After all, I had to pay for the papers every week or I was out of a job.

And then I remember Dad paying his bills once a week. He sat at his iconic desk and wrote out his checks. And then to the mailbox, he trekked as predictably as the sun would set. Off the payments went. Save for an almost never-ending mortgage that he had on our home later in life, he never had an overdue bill.

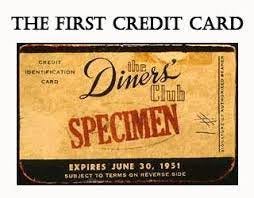

The first credit card was the Diners Club introduced in February 1950

In January 1950, the total credit card debt in the United States was $19,050.87

Today, Americans have a mountain of credit card debt of $1,166,000,000.

Ahhh, so very different . . . .

Thanks, Tom, for helping me revisit those memories.

© 2025

HaHa. Yup, I forgot about the Green Stamps play. We had books and books of them.

Ahhhh what a wonderful reflection of a time when things were simpler, people seemed nicer, hi-tech wasn't around to infuriate us and bills actually were paid on time!! Thank you for this.